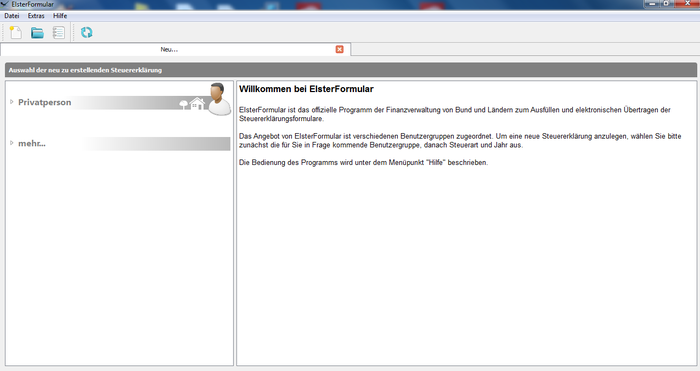

Each item is numbered and matches the fields in ELSTER, so it’s just a case of filling in the blanks. The annual wage and tax statement issued by your employer ( Lohnsteuerbescheinigung) contains all the necessary information you’ll need to file a declaration, provided you have no extra income sources. You don’t have to submit this paperwork, but you do have to keep it for 10 years in case you get audited, or in case the tax office needs additional information from you. Freelancers will need details of all their earnings and expenses, backed up by the corresponding invoices and receipts. This should be sent to your home address each year by your employer. If you’re employed, you’ll also need your annual wage and tax statement ( Lohnsteuerbescheinigung). You can also outsource your declaration to a tax consultant (.more on that later). ELSTER is only available in German, but luckily there are a few online tax tools available in English, such as Taxfix or Steuergo. All you have to do is sign up on the website and you’ll be sent a code in the mail, which you use to finish setting up your account. As an employee, you can choose to submit a paper copy. This number is yours for life, so keep it safe!ĮLSTER: If you’re self-employed, tax declarations must be submitted electronically using the ELSTER tax portal online. Tax identification number ( Steuer-Identifikationsnummer ): You’ll automatically receive a tax ID number after you register your German address with the local registration office ( Bürgeramt). Note that if you move to a new district, you will automatically be issued with a new number when you register in the area. Tax number ( Steuernummer ): If you don’t already have one, submit your first German tax declaration and your district’s tax office ( Finanzamt) will issue you a tax number. What you’ll need to submit your tax declaration

0 kommentar(er)

0 kommentar(er)